Planning for Retirement Success: How Cash Flow Modelling Helps Create a Solid Financial Roadmap.

Introduction to Cash Flow Modelling

Retirement planning is a crucial aspect of financial management that requires careful consideration and expert guidance. One of the most effective tools used by financial advisers to create a solid retirement plan is cash flow modelling. But what exactly is cash flow modelling and how does it work?

Cash flow modelling is a financial planning technique that involves projecting your income, expenses, and investments over a specified period of time, typically throughout your retirement years. This allows you to have a clear understanding of your financial situation. This allows for informed decisions to be made to achieve your retirement goals.

What is Cash Flow Modelling and How Does It Work?

Cash flow modelling involves creating a detailed financial plan that takes into account various factors such as your current income, expenses, assets, and liabilities. Using a sophisticated software program, financial advisers can simulate different retirement scenarios and analyse the impact of them.

For example, it can help determine how much you need to save for retirement, how long your savings will last, and what adjustments may be necessary to ensure a comfortable retirement. It considers factors such as inflation, investment returns, and changes in income and expenses over time to provide a comprehensive picture of your financial future.

Benefits in Retirement Planning

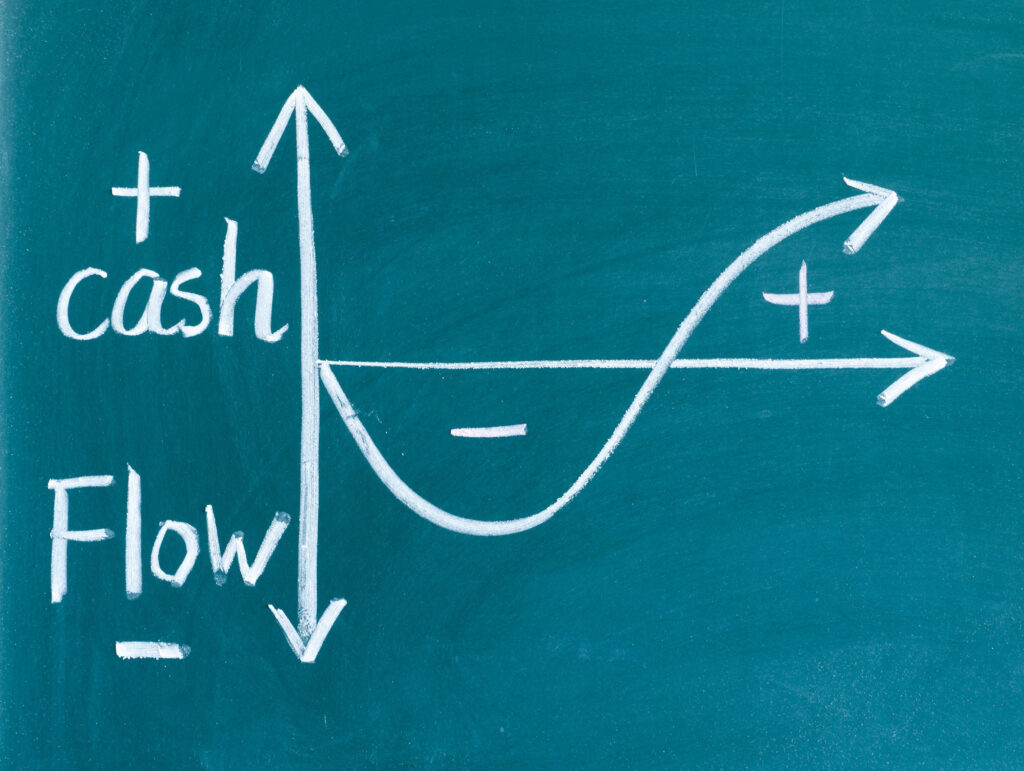

Cash flow modelling offers several benefits when it comes to retirement planning. Firstly, it provides a visual representation of your financial situation, allowing you to see how different variables can affect your retirement goals. This can help you make more informed decisions and adjust your savings and investment strategies accordingly.

Secondly, it allows you to test different scenarios and assess the potential impact of major financial decisions, such as downsizing your home, retiring early, or making large purchases. By having a clear understanding of the consequences of these choices, you can make more confident and well-informed decisions.

Lastly, it helps you create a realistic retirement plan that takes into account unexpected expenses and potential risks. It can provide insights into potential shortfalls in your retirement savings. This help you develop strategies to mitigate these risks, such as adjusting your spending habits or exploring additional income sources.

Understanding Retirement Planning

Retirement planning involves setting financial goals and developing a plan to achieve those goals during your retirement years. It requires a thorough analysis of your current financial situation, including your income, expenses, assets, and debts. By understanding your current financial position, you can make informed decisions about how much you need to save and invest to secure a comfortable retirement. It is key to model based on the differing costs at each of the three stages of retirement.

Retirement planning also involves considering various factors that can impact your financial future. These are such things as inflation, investment returns, and changes in lifestyle. By incorporating these factors into your cash flow model, you can create a realistic and flexible plan that adapts to changing circumstances.

The Role of Cash Flow Modelling in Retirement Planning

Cash flow modelling plays a crucial role in retirement planning by providing a comprehensive view of your financial future. It helps you understand the potential impact of different financial decisions. This then allows you to make adjustments to your retirement strategy as needed.

By incorporating cash flow modelling into the retirement planning process, financial advisers can ensure that their clients have a realistic and achievable plan in place. It helps them identify potential risks and develop strategies to mitigate those risks, ensuring a solid financial roadmap for retirement.

How Modelling Helps Financial Advisers Create a Solid Financial Roadmap for Retirement

Financial advisers utilise cash flow modelling to create a solid financial roadmap for retirement by analyzing various scenarios and identifying the most suitable strategies for their clients. By inputting data such as income, expenses, assets, and liabilities into the cash flow model, they can assess the impact of different variables and make informed recommendations.

For example, it can help determine the optimal age to retire, taking into account factors such as expected lifespan, inflation, and investment returns. It can also provide insights into the amount of savings required to maintain a desired lifestyle during retirement.

Financial advisers can use the model to identify any potential shortfalls in their clients’ retirement savings and develop strategies to bridge the gap. This may involve adjusting investment portfolios, exploring additional income sources, or making lifestyle changes to reduce expenses.

Steps to Create a Cash Flow Model for Retirement Planning

Creating a cash flow model for retirement planning involves several steps. These steps may vary depending on the specific circumstances of each individual, but generally include the following:

- Gather financial information. Collect data on your current income, expenses, assets, and liabilities. This will serve as the foundation for your cash flow model.

- Define retirement goals. Determine your desired lifestyle during retirement and set specific financial goals to achieve that lifestyle.

- Input data into the cash flow model. Use specialized software or tools to input your financial information into the cash flow model. This will allow you to simulate different retirement scenarios and analyze the potential impact of various financial decisions.

- Analyze and adjust: Review the results of the cash flow model and analyze the potential outcomes. Make adjustments as necessary to ensure your retirement goals are achievable.

- Monitor and update. Regularly review and update your cash flow model to reflect any changes in your financial situation or goals. This will help you stay on track and make necessary adjustments to your retirement plan.

Common Misconceptions

Despite its effectiveness, cash flow modelling is still surrounded by some common misconceptions. One of the most prevalent misconceptions is that it is only for the wealthy or those with complex financial situations. In reality, it can benefit individuals of all income levels and financial circumstances.

Another misconception is that it is a one-time exercise. In fact, it should be an ongoing process that is regularly reviewed and updated to reflect changes in your financial situation and goals.

Lastly, some people believe thatit is too complicated and time-consuming. While it does require some expertise and specialised software, it is ultimately a tool that can simplify the retirement planning process and provide valuable insights into your financial future.

Finding a Financial Adviser Who Utilises Cash Flow Modelling

If you are considering retirement planning and want to incorporate cash flow modelling into your financial strategy, it is important to find a financial adviser who is experienced in utilizing this technique.

Look for financial advisers who specialize in retirement planning and have a proven track record of helping clients achieve their retirement goals. Ask about their use of cash flow modelling and how it has benefited their clients in the past.

Additionally, seek recommendations from friends, family, or colleagues who have worked with an adviser who has successfully utilised cash flow modelling in their retirement planning. Personal referrals can provide valuable insights into the expertise and professionalism of a financial adviser.

Conclusion and the Importance of Cash Flow Modelling in Retirement Planning

In conclusion, cash flow modelling is an essential tool for financial advisers when creating a solid financial roadmap for retirement. It provides a clear and comprehensive view of your financial future. This then allows the making of informed decisions and adjustmensts to a retirement strategy.

By incorporating this into your retirement planning process, you can identify potential risks, develop strategies to mitigate those risks, and ensure a comfortable and secure retirement.

Want to Read More?

Related arictles on this can be found in our May – June 2023 newsletter and our May – June 2021 newsletter.

Need Help or Advice?

If you are considering retirement planning, it is crucial to work with a financial adviser who utilises cash flow modelling as part of their retirement planning service. Compton Financial Services is one such firm that does so and always incorporates it into its Retirement Planning service.

If you’re looking for help or advice have a look at our website for ways we can help.. Or if you prefer to talk about your specific situaiton you can book a free 30 min meeting via this link.

Compton Financial Services Limited is an appointed representative of New Leaf Distribution Ltd which is authorised and regulated by the financial conduct authority (FCA). FCA number is 460421.

Our services relate to certain investments whose prices are dependent on fluctuations in the financial markets beyond our control. Investments and the income from them may go down as well as up and you may get back less than the amount invested. Past performance cannot be used as a reliable prediction of future performance.